How We Find 100+ Product Ideas to Sell on Amazon Every Day

Feb 18, 2026

Most people who fail selling on Amazon fail for one reason.

They chose the wrong product.

Not because they lack effort. Not because Amazon is broken. But because they never learned how to evaluate product ideas the way a business operator does.

Over the last six years, we’ve launched more than 330 products on Amazon and generated over $28 million in revenue for our partners. That volume forces you to get good at one thing very quickly: deciding which products are worth launching and which ones should be ignored.

This article walks through how we consistently find product ideas to sell on Amazon, how we filter Amazon product ideas that look good but fail in practice, and how we think about product ideas for Amazon FBA as an investment decision rather than a guess.

Why Most Amazon Product Ideas Fail

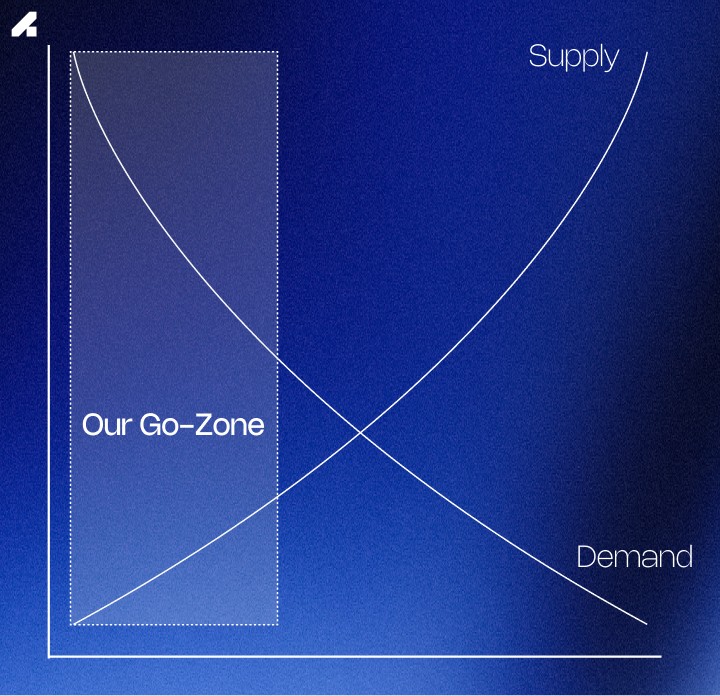

Amazon is a marketplace. That means every product category has three forces at work:

Demand

Supply

Market size

Most people only look at one of them.

They see a product selling well and assume it’s a good opportunity. In reality, strong sales often attract competition, compress margins, and eliminate room for new entrants.

Good product-selling ideas on Amazon live where these three forces are misaligned in your favor.

Step One: Generate More Product Ideas Than You Need

The biggest mistake beginners make is falling in love with a single idea.

If you want to sell products on Amazon successfully, you need volume at the idea stage. Not one idea. Not ten. Hundreds. Max. Volume.

This phase is exploratory. The goal is collect ideas, then sort them later.

Here are reliable ways to generate Amazon product ideas quickly.

Browse Amazon Like a Customer

Start on Amazon’s homepage. Click into broad categories. Drill down into subcategories. Write down product types and category names, not specific listings.

Don't look for “winning products" quite yet. You are only collecting categories worth researching.

Review Your Own Purchase History

Your Amazon order history is a record of problems you were willing to pay to solve. Every product you’ve purchased represents a category with existing demand.

Write down the search term you would use to find each product.

Walk Physical Stores

Grocery stores, hardware stores, Walmart, and Target are excellent sources of product ideas for Amazon FBA.

Focus on physical, non-consumable products that are used repeatedly but not replaced constantly. Focus on shelves that are eye-level, or if you're selling to kids, about a foot from the floor.

Consumables can work, but sourcing and logistics are harder.

Use Amazon Data Tools

Software like Helium 10, JungleScout, and Amazon’s Product Opportunity Explorer help expand your list. Suggested keywords and niche clusters often surface product ideas most people miss.

Think in Niches, Not Categories

Broad categories are crowded. Niches inside those categories often aren’t.

Camping is crowded. Heated gloves is a niche. Organization is crowded. Drawer dividers for a specific use case might not be.

Niches are where new product ideas for Amazon are usually found.

Remember, if you're willing to do the work most aren't, you'll get the results most don't.

Step Two: Measure Demand the Right Way

Once you have a large list of product ideas, it’s time to evaluate demand.

We start with annual search volume. As a general rule, we want to see at least 1,000,000 searches per year across the core keyword set. That tells us enough people care.

But demand alone is meaningless without context.

Next, we calculate market size.

Amazon provides a metric called search conversion rate, which tells you how many people who search actually buy. Multiply annual search volume by search conversion rate and then by average retail price.

That gives you yearly niche revenue.

This is the market cap of the category. If the total market is too small, even a good product will struggle to produce meaningful returns.

Step Three: Identify Supply Risk Before It Destroys You

Supply is where most Amazon sellers get wiped out.

A category can look attractive until a better-sourced competitor enters and collapses pricing. This happens constantly, especially in simple products where overseas manufacturers can undercut margins. For example, in China, there are government subsidies and rebates for Chinese companies involved in the U.S. consumer markets. That means they cna undercut your price by up to 15% without feeling it in their margins at all.

To evaluate supply, we look at these several key signals.

KEY POINT: You MUST find a category & supplier combination that can support a target Gross Margin of at least 70%. Launching on Amazon without a 70%GM capable category drops your chance at profitability to "very slim."

Average Retail Price

Markets trend toward efficiency. If prices are already compressed, there is little margin left to extract. If prices are unrealistically high, competitors will rush in.

You want room above market efficiency, not at it.

Cost Per Click Ratio

Advertising is unavoidable when you sell products on Amazon.

Cost per click divided by average retail price gives you your cost per click ratio. Below five percent indicates favorable competition. Above that, advertising alone can destroy margins.

Click Share Concentration

Inside Product Opportunity Explorer, we look at how much click share the top listings control.

If the top five or top twenty listings dominate clicks, the category is likely brand loyal or controlled by entrenched sellers. If there is meaningful click share left over, opportunity exists.

Review Distribution

Average review count versus median review count tells you a lot.

Very high averages often indicate brand loyalty. Large gaps between average and median suggest a few dominant listings. Low numbers across both may indicate weak demand.

Step Four: Estimate Realistic Market Share

Even good product ideas fail when expectations are unrealistic.

Most well-executed Amazon FBA products capture one to three percent of their niche market annually. Exceptional listings might reach seven to ten percent, but planning for that outcome is risky.

When evaluating product ideas for Amazon FBA, we always ask:

What happens if we only get one percent?

If the business does not work at one percent market share, it is not a good product idea.

Step Five: Validate Profit Before You Launch

The final filter is profitability.

Once a product idea passes demand and supply checks, we quote manufacturing costs and estimate Amazon fees, shipping, storage, and advertising.

Then we risk-adjust.

If you believe there is a 70% chance your assumptions hold, reduce projected profit by 30%. We call this "risk adjustment forecasting". Conservative estimates prevent expensive surprises.

A category can look perfect on paper and still fail if cost of goods are too high. This is why product research without manufacturer pricing is incomplete.

Why This Process Works

Finding good Amazon product ideas is not about intuition. It is about probability.

By evaluating hundreds of product ideas and filtering them through demand, supply, market size, and margin, you dramatically increase the odds that the products you launch succeed.

Most sellers fail because they stop too early. They find something that looks promising and rush to market. We assume the opposite. We assume the idea is wrong until the data proves otherwise.

That discipline is what turns product ideas into businesses.

Final Thought on Selling Products on Amazon

Amazon is not forgiving. But it is predictable.

If you choose the right product, the platform works. If you choose the wrong one, no amount of optimization will save you.

This is why product selection is the most important decision you make when starting or scaling an Amazon business.

And why we spend so much time getting it right.