Should You Start an Amazon Store in 2026?

Feb 4, 2026

Should You Sell on Amazon in 2026

A Realistic Look at Amazon FBA as a Business, Not a Side Hustle

Selling on Amazon in 2026 sits in a strange place.

Some people will tell you Amazon FBA is dead. Others will tell you it’s the easiest money online. Both are wrong in predictable ways.

Amazon is not dying. It is also not forgiving.

If you approach Amazon the way most people still do, copying listings and hoping volume bails you out, it will be expensive, slow, and frustrating. If you approach it the way an operator or investor does, it can still be one of the most efficient ways to build a cash-flowing digital asset.

The difference is in the business structure.

This article breaks down what selling on Amazon actually looks like in 2026, what Amazon FBA really costs, where people fail, and what has to be true for it to work.

Amazon Is Saturated. That’s Not the Problem.

Amazon is a marketplace. Marketplaces always look saturated when you zoom out.

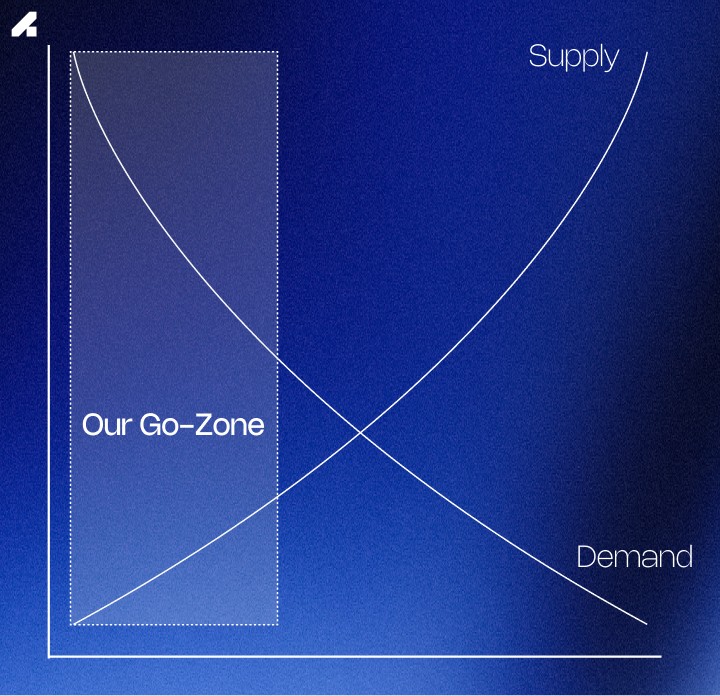

What matters is not how many sellers exist, but whether specific categories have imbalances between supply and demand. Those gaps still exist. They are just harder to see and easier to misread.

Most people scan Amazon the wrong way. They see high sales volume and assume there's an opportunity. What they miss is who owns that volume and why.

Certain categories are brand-loyal by nature. Running shoes are a good example. Buyers aren’t searching for a generic option. They are searching for Nike, Hoka, or Asics. In those markets, even a well-priced product with good photos will struggle against listings with ten thousand reviews and decades of brand equity.

In 2026, competing with brand loyalty is a losing game.

The Amazon businesses that still work avoid those categories entirely. They operate in niches where buyers are searching for a solution, not a logo. Demand exists, but supply is fragmented or poorly executed. That is where Amazon still rewards competence.

Why Most People Fail When They Try to Sell on Amazon

The most common Amazon FBA strategy pushed online looks efficient on paper and collapses in reality.

It usually goes like this:

Find a product with strong demand. Copy an existing listing. Source the cheapest version possible. Compete on price. Hope volume makes up for thin margins.

This approach creates three problems.

First, there is no control. Your margin depends on temporary sourcing advantages, coupons, or supplier luck. That is not a business. That is arbitrage with decay.

Second, it requires enormous volume to matter. When profit per unit is small, returns only show up after months or years of reinvestment. Most sellers underestimate how long that takes and how fragile it is when ad costs rise.

Third, it teaches the wrong skills. You are not learning how to build a product, position it, or defend it. You are learning how to nickel-and-dime a platform that is getting more competitive every year.

This is why so many Amazon sellers quietly stall out. They are busy, but they are not building leverage.

This is why most Amazon Seller Central accounts die with a whimper.

What Changed About Amazon FBA

Amazon used to behave like a gold rush. First one there, and you'll make large volumes of profit.

The gold rush is over.

In 2026, Amazon's key advantage is distribution. It's not going to solve all your problems, but it will find you customers.

The platform rewards sellers who understand supply chains, unit economics, and conversion systems.

The platform "hacks" have been patched. It's time to play the long game.

Three things matter more than they used to:

Product quality

Reviews still drive everything. Low-quality products are filtered out faster than ever.

Supply chain control

Stockouts and inconsistent costs kill momentum. Sellers who cannot manage inventory properly bleed ranking and cash flow.

Conversion performance

Traffic alone does not win. Listings must convert. That requires pricing, positioning, imagery, and copy that work together.

Amazon now holds the cards; they don't care if you succeed. It's up to you now.

The Real Cost to Sell on Amazon FBA

One reason people ask about Amazon FBA cost is because the numbers are often misrepresented.

There is no zero-dollar Amazon business.

In fact, they've gone as far as outlawing dropshipping on their platform.

To sell on Amazon seriously, you need capital for product development, inventory, advertising, and time. Compared to real estate or traditional business acquisitions, the barrier to entry is still low. Compared to online myths, it is not cheap.

Amazon's development into marketplace maturity has pushed the small players out.

In practice, building an Amazon store the right way usually starts around the cost of a modest vehicle, not the cost of a laptop.

Trying to do Amazon at the lowest possible budget is usually the most expensive path long-term.

If you want to try Amazon with $0, you should go to flipping items on Facebook Marketplace instead.

How Professionals Analyze Demand on Amazon

Serious operators look at how to sell on Amazon differently from beginners.

Demand is measured annually, not weekly. A product category needs enough yearly search volume to support sustained growth, not a temporary trend.

Retail pricing matters. Products priced too low compress margins and make advertising unforgiving. Many successful Amazon businesses operate in a mid-range price band where there is room for profit and flexibility.

Advertising efficiency is critical. Amazon FBA relies heavily on pay-per-click ads. If clicks cost too much relative to price, the math breaks quickly. Healthy categories allow sellers to acquire traffic without burning margin.

None of this matters if the listing does not convert. Traffic without conversion is wasted spend. This is why creative assets and content are not cosmetic. They are economic.

The Bottom Line: The Role of Amazon FBA in 2026, And Is It Still Worth It?

Selling on Amazon in 2026 means you are competing against experienced sellers, global manufacturers, and a platform that optimizes relentlessly. The edge comes from doing the unglamorous work correctly.

That includes product selection, sourcing, branding, inventory planning, advertising discipline, and ongoing optimization.

The businesses that succeed treat Amazon FBA like what it is: a real business with leverage.

Amazon is not dead. It is mature.

For people looking for fast money, it is the wrong place. For people willing to build a structured, defensible business, it remains one of the most powerful platforms available.

If you approach Amazon like an investor, focusing on durability, margin, and systems, the model still works. If you approach it like an online hustle, the platform will expose that quickly.

That distinction matters more in 2026 than it ever has.